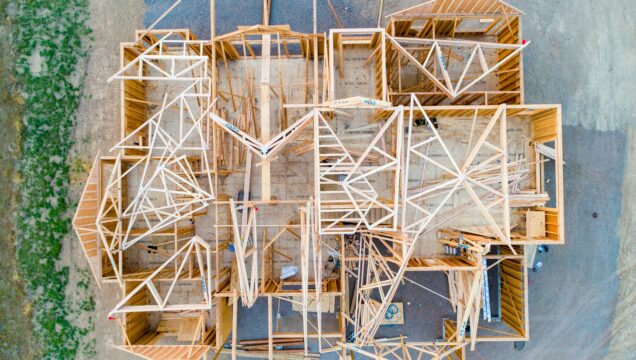

Sourcing finance for a development can be as stressful as building the site itself. But it doesn’t have to be.

The development finance market has grown exponentially since the financial crash.

We remember back in 2010, when there were less than 5 lenders, whereas now there are hundreds. The market is awash with options, and we’re opening it up to every borrower.

At PFG, you can search and compare Development Finance from the breadth of the market and see live borrowing options, instantly.

With arrangement fees, exit fees, non-utilisation fees and lender professional fees to consider, as well as the interest rate, seeing real-time borrowing costs laid out before you start a project is game-changing.

Even the most experienced developers use us to source funding to ensure they get the best deal available.

Minimum Loan: £150,000

Maximum Loan: No limit

Loan-to-GDV: Up to 75%

Loan-to-Cost: Up to 98%

Number of Lenders: 75+ (senior / mezz / equity)

Rates: Starting from 3.0% (Lender Margin over Cost of Funds)

Loan terms: Typically between 9 and 48 months

Payment terms: Lender interest and fees to be paid on redemption (as standard)

Largest Development Loan Completed to date: £52m

Ideal for: Developers of all sizes and experience; we work with first-time developers through to Regional and National housebuilders

At Property Finance Group, you can leave us to arrange the finance so you can get on with doing what you do best. Here’s why:

Tech-empowered EFFICIENCY:

Using instant loan sourcing tech frees our time to understand your business and aspirations, and plan and strategise with you, while seamlessly managing every step of your application.

Market access and visibility:

Our tech is available for you 24/7, so you can instantly access live loan information, check your deals stack and avoid wasting time on unviable projects.

from start to finish fast:

An instant market-wide digital search + lender-favoured application process means you can receive a same-day Decision In Principle (DIP).

building your success:

We deliver the best specialist property finance on the market, helping you spread your equity, diversify investments and grow your business.

A partnership for the long-term:

As industry experts, we navigate challenges to craft finance for every project – from first-time to seasoned property investors & developers, we’re here for your journey.